By Rod Daugherty, VP Product Strategy of Blue Ridge

Tariffs and Inflation: A Good Time to Forward-Buy Inventory?

Buy low, sell high’… If you took anything away from any Economics class, that’s probably it. Now that Trump’s import tariffs have pushed inflation to the highest it has been in six years, many retailers and distributors are putting that strategy into play. In cases where suppliers pre-announce a price increase or promotion on a high-turnover item, forward buying can be an attractive choice. There’s a fine line, though, between buying inventory ahead of inflation and cannibalizing your profits.

Don’t forward buy just to do it. Your savings could be negated by the cost of carrying inventory you can’t sell. Finding that perfect balance — no stockouts, no surplus, no surprises — requires deep analytical capability and the tools to make the right decisions at exactly the right time. NOT an easy task in today’s highly volatile and complex supply chain.

So the question is not “Should you forward-buy?” But rather, “Are you ready for it?”

Before you decide, let’s take a look at the bigger picture:

- Where is inflation going?

- What are the pros and cons of forward buying?

- Why is demand forecasting so difficult?

- Are you ready? Do you have the right technology to make the right purchasing decisions at the right time, to protect your profits?

INFLATION IS TRENDING

2.9%Immediately following chatter about the import tariffs and possible trade wars, U.S. consumer prices rose by 2.9 percent nationally in the 12 months ending in June (the highest inflation increase in six years). While the Federal Reserve is okay with that figure, economists predict consumer prices will climb higher if the Administration continues to impose steep tariffs on a wide range of imported goods. Signs certainly point to an upward trend, making forward-buy an attractive supply chain strategy.

Price hikes will be felt most by businesses downstream the supply chain that rely on imported steel (25-percent tariff) and aluminum (10-percent tariff) to make their products.

For consumers, wallets will be hit hardest in the areas of dining out (prices up 3.6 percent); alcoholic beverages (up 3.9 percent), and gasoline (up 26.8 percent). For example, a 20- to 50-percent tariff on washing machines from China, South Korea and Mexico could increase the price of foreign-made washers from $50 to $90. We’ve already seen a 20-percent tariff on Canadian lumber bump housing prices by $9,000!

One thing for sure is that prices for everything are going up. If wholesalers and distributors don’t react to that, they’re losing profit.

FORWARD BUYING: PROS AND CONS

A smart forward buy on inventory could bring five to 20 percent in additional savings to wholesalers, distributors and retailers. Merchants may also be able to pass on savings downstream to their customers, an added perk that can extend profitability further and cement their reputation in the market as a price leader, without sacrificing much.

Good candidates for forward buying are: non-perishable goods or perishable goods with a long shelf life (nothing that will be out of date within 30 or 60 days), as well as products in hard lines, such as heating/AC parts, automotive parts, etc.

But whoa, Nelly. Before you run out and borrow cash, beware. Because inventory is the biggest asset on the profit-loss statement, you must hedge your investment buy against inflation so that you are operating profitably at all times.

Excess or dead inventory makes forward buying risky without the right math behind it:

- Inventory carrying costs are about 12 percent of the average unit cost of production

- Anywhere from 20 to 30 percent of inventory is dead or obsolete, even in well-run companies

- Interest rates on loans for extra stock are running up to eight percent

OUCH.

FORECASTING DEMAND: PATTERNS ARE EXTINCT

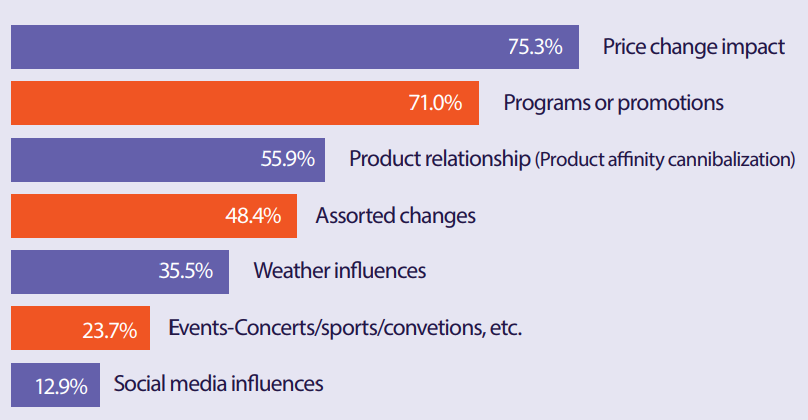

So how do we determine what to purchase and when, so as to minimize unsold goods? Historically, supply chain managers used manual forecasting methods. This got tricky when it came to running promotions; but for the most part, they could maintain that balance by watching demand patterns. It was typically a spreadsheet, rule of thumb or a gut feeling. When you look at today’s increasingly complex demand volatility – there are no patterns anymore.

Manual demand forecast techniques can no longer react to demand volatility in today’s complex, multi-echelon supply chain. More automated supply chain analytics and real-time intelligence tools are required to effectively forecast, plan, collaborate and execute on forward buying. Or any supply chain strategy, for that matter.

TECHNOLOGY TRUMPS HUMANS

[Pardon the political pun].

Technology is the only way to effectively gauge demand volatility, react, and re-plan for elusive macro-economy conditions such as tariffs. Technology should not replace humans, but rather automate the constantly changing math inputs and providing daily recommendations, which humans can use to make better purchasing decisions faster.

Supply chain planning solutions do the heavy lifting – such as optimizing every SKU/location nightly – which would be impossible, even for a massive team of forecasting, planning and replenishment professionals, without technology.

HOW SUPPLY CHAIN PLANNING SOLUTIONS WORK

A purpose-built supply chain planning solution such as Blue Ridge Software taps into all the demand factors (price changes, promotions, etc.) to optimize purchasing decisions… not once, but constantly. Much like the Waze app, which delivers dynamic route recommendations to drivers based on real-time data (traffic, law enforcement), Blue Ridge constantly monitors demand signals and current supply chain conditions – then maps out recommendations at exactly the right time. Then it’s up to the user to decide: buy or don’t buy.

The platform gets a nightly feed of data from automated systems and re-plans a 365-day forecast every day based on reasonable certainty that you will sell products, versus purchasing overstock. In addition to normal replenishment orders, you can use the platform to evaluate special-order considerations such as forward buying in cases where you want to:

- Buy ahead of price increases to hedge against inflation

- Get special deals or volume discounts

- Leverage a promotion

- Hit supplier growth program targets

The system calculates whether additional quantities will increase gross profit after you’ve built orders to serve normal customer demand. Recommendations come in advance of the purchase, so you can meet your customers’ needs first, then separately evaluate the economics of any other considerations.

We’ve seen supply chain planning solutions bring significant results in a number of areas:

- Service levels close to 100 percent

- Improved hit rates and fill rates

- Increased turns, sales and profits

- Inventory and overstock reductions

- Reduced backorders; fewer lost sales

- Greater labor efficiency

Nifty huh?

HOW TO GET STARTED

So it’s settled then. Forward-buying can be a great strategy against tariff-related inflation, if you have the technology to crack the supply chain code. The benefits of forward buying can be huge:

- Optimize the economics of every single purchase order

- Eliminate lost sales

- Minimize excess supply chain costs

Blue Ridge helps customers crack the supply chain code:

- 40% Efficiency Gain:

Top-25 Foodservice Distributor - 25% Inventory Reduction:

Leading European Retailer of Safety Products & Cleaning Supplies - 181% Profit Increase:

Regional Food Wholesale Distributor

But don’t waste resources on a supply chain planning solution unless it offers all four of these criteria:

- Purpose-built. Is the platform designed specifically for commerce, or is it an ERP system retrofitted for the masses? The system should be able to analyze each customer transaction individually and automatically generate actionable recommendations daily. Many other solutions force users to integrate data from multiple modules and navigate across these modules – resulting in duplicated efforts, inefficiencies and security risk. A purpose-built supply chain planning application is unified in a single, secure cloud suite.

- Cloud-native. Is the solution cloud-native (really)? There’s a lot of “me-too” marketing going on with “hybrid” or “cloud + on-premise” solutions. No one can be both. Legacy solutions are often migrated to the “cloud,” rather than architected from the cloud-up – so they fail to leverage the massive data processing power, storage capability and scalability of a cloud-native architecture.Some are simply older cloud or on-premise solutions – only now available hosted in the provider’s data center or somewhere else. More than likely, the provider is still amortizing a huge investment they made in technology long ago. The UX looks Circa 1985 – perhaps with a little lipstick – but the workflow process is old and clunky. Be especially wary of the “hybrid” cloud, a term that means the provider has not made a commitment to solution architecture, either on-premise or in the cloud. These faux-cloud solution providers are opportunists just checking the box on “Cloud.”Blue Ridge has invested heavily in computing power to make things as easy as possible for customers, both day-to-day and during initial implementation. Rather than owning a huge server and database suite that will only get used a tiny slice of the day, a cloud-native solution offers the freedom to spin up/down server capacity as needed. The barrier of entry is much lower, time to implement is much faster, and costs are nil (comparatively).

- Multi-echelon collaboration. The supply chain is no longer a linear, “sell-one, buy-one” process. It is a complex multi-echelon ecosystem. Each store, DC and supplier has their own distinct demand forecast. It would be too time-/cost-prohibitive to produce precise order projections for every SKU and location, optimize those across echelons, and communicate a 365-day demand plan to everyone. Is there a feature that supports multi-echelon collaboration, both up- and down-stream?Blue Ridge’s Multi-Echelon Inventory Optimization (MEIO) feature allows users to send customized details about a demand plan to suppliers with complete synchronization across any multi-echelon supply chain – virtually eliminating manual effort and solution integration overhead.

- Consulting included. Finally, no supply chain planning provider should make more money off consulting than the software itself. After all, it’s about software and making customers profitable. Yet, many drag out the engagement forever, charging extra consulting hours for continuous improvement services that should be inherent.With a cloud-native solution, the system can constantly access customers’ databases and scan their environments to make unsolicited recommendations for improving profitability and service levels. It’s a baked-in value add. Blue Ridge’s supply chain consulting team sends real-time alerts about problems and opportunities, including: quarterly executive briefings, ongoing KPI assessments, seasonal forecast assistance, period-ending fine tuning, and category management analyses. If a provider tells you these are additional onsite engagements, you’re leaving money on the table.

Ready to Transform Your Business?

Schedule a Solutions Overview today!

THANK YOU!

We appreciate your interest in Blue Ridge! We have received your request. A member of the Blue Ridge team will get back to you as soon as possible.