HVACR Distribution Stats: The Good, The Bad, The Ugly

Today we’re taking a break from our series on Pricing Strategies to focus on the COVID-19 situation for HVACR distributors. HARDI Pulse published some interesting stats this week that I wanted to share.

Today we’re taking a break from our series on Pricing Strategies to focus on the COVID-19 situation for HVACR distributors. HARDI Pulse published some interesting stats this week that I wanted to share.

First, the Good News

Due to the early recognition of HVACR as an essential industry, production from suppliers has been very strong during the pandemic. In a survey this week of 63 manufacturers,

- 94% of suppliers do not expect any challenges in meeting distributors’ orders

- Aside from the fact that 8% shut down their production facilities this week due to COVID-19, a rate of 92% running at full production capacity ain’t bad… all things considered!

- 65% have not experienced supply chain disruptions this week

In addition, HARDI surveyed 128 HVACR distributors to reveal that customer ability to pay is not as big of a worry as one would suspect right now. It is certainly not ideal, but one might suspect it to be worse. Similar to their survey last week,

- 42% of respondents have seen no recognizable change to customers’ paying performance

- 36% have less than 15% of their customers extending payment schedules

- 61% indicated their customers have applied or plan to apply for a loan, which could mean collections is not an immediate threat for now

- 49% reported that less than 15% of their customers are asking for extended payment terms

Now, the Bad. Sales.

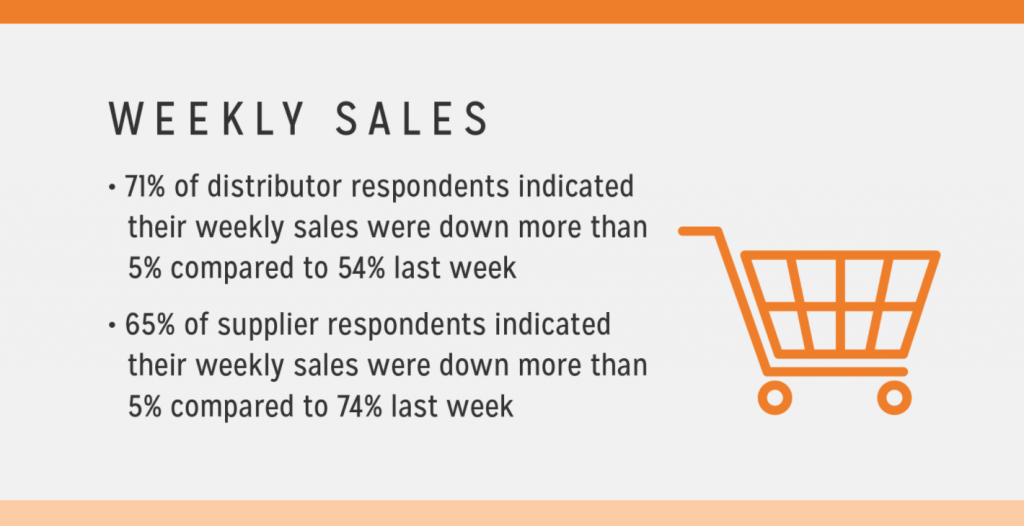

While we were pleased to see supply and receivables relatively stable, distributors’ sales data tells a different story. Most disturbingly,

- 20% of HVACR distributors indicated their customers are shutting down

- Weekly sales are down more than 5% for nearly ¾ of distributors, compared to just over ½ of respondents last week

The Ugly: Demand Planning the Old-School Way

The ugly of this is watching companies figure out how to handle demand planning on a rapidly moving target.

These stats are changing so quickly. This week’s good news could be next week’s bad. Next week’s bad could become the new ugly. The real ugly is that there are companies still out there trying to plan for all of this without a demand planning solution in place.

Either they are using Excel (ouch) or a rigid ERP or WMS system that was never intended for the unique business realities of the HVACR industry, such as erratic demand from regional uniqueness, seasonality and market fluctuations (which we are certainly not a stranger to right now!).

A distribution-focused, cloud-native demand planning solution balances these realities with unmatched forecast accuracy, inclusive of all things touching an HVACR distributor’s profitability – from supplier constraints and long or unpredictable lead times to deal opportunities, promotions and much more.

Learn more about demand planning solutions for HVACR and Plumbing

Comments are closed.